Outlook Money has remained India’s No.1 personal finance magazine for the last 25 years, delivering accurate, insightful, balanced and practical information to our readers that is easy to understand and implement. Since our inception in 1998, we have focused on consumer interest and benefits. We empower our readers by giving in-depth analysis and credible information on investments, insurance, taxation, banking, financial planning and all things related to your household budgets and financial goals. We are not an investment-only magazine, though stocks and mutual funds inevitably form a significant chunk of our content, because we are concerned about the overall financial well-being of individuals and not just wealth creation.

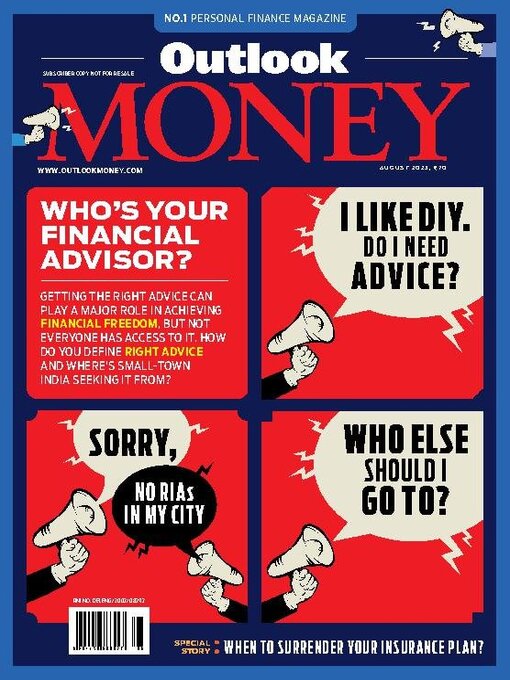

In Search Of The Right Advice

Talkback

Outlook Money

THE FINANCIAL SHERPA YOU NEED • Getting the right advice can play a major role in achieving financial freedom, but whose advice are you taking? We sift through the financial advisory landscape in India to look at the options investors have and where they should go

SHOW ME THE MONEY • The number of registered investment advisors (RIAs) is higher in states where per capita investment is higher

HOW TO GO DIY • IF YOU DO NOT HAVE ACCESS TO GENUINE ADVICE, HERE'S WHAT YOU CAN DO

10-POINT CHECKLIST TO CHOOSE A FINANCIAL ADVISOR

5 STEPS TO CLOSE THE GAP…

THE UNINTENDED SCAPEGOATS • Sebi’s tightening grip on registered investment advisors is mainly aimed at regulating those who are solely into stock advisory and the like. But RIAs who are into comprehensive financial planning are having to bear the brunt

CHANGING REGULATIONS • IN THE LAST 10 YEARS, SEBI HAS MADE SEVERAL CHANGES IN THE REGULATIONS FOR REGISTERED INVESTMENT ADVISORS

10 Financial Freedom Commandments to Embrace this Independence Day • The sweet success of financial freedom draws people into giving everything they have, sometimes hard sacrifices, so it is only fitting that we rekindle this spirit on the 77th Independence Day

SMALL TOWNS, BIG WEALTH • Old-school trusted advice combined with curiosity about new-age investments defines HNIs of smaller cities. The investment decisions they make now can have far-reaching impact on the financialisation of the country's economy in the long run

GROWING TRIBE

GOOD TIME TO BOW OUT OF YOUR ENDOWMENT POLICY? • Endowment policies, typically, offer low coverage and returns compared to other insurance and investment products. If you have one, should you surrender it? If so, when is the right time?

HIGH COST OF SURRENDER • There is a high cost to pay if you surrender the policy before the term ends. But if you surrender the policy early, you may not even recover the premiums paid though your loss versus the paid-up value, which is what you finally get after bonus additions to the sum assured, is lower. This can, however, be recovered if you invest systematically thereafter (see When Should You Surrender?)

WHEN SHOULD YOU SURRENDER? • The earlier you surrender, the more beneficial it will be for you if you split the future premiums to buy a term plan and invest the rest in an index fund

Taking Advantage Of Arbitrage Funds • You can get a significant tax advantage in arbitrage funds if the holding period is over a year, but remember that it is not a substitute for liquid funds

PARAG PARIKH FLEXI CAP: LONG-TERM HERO

SIP IS KEY TO GOALBASED INVESTING • If target-setting is central to achieving your financial goals, then the systematic investment plans (SIPs) are the best approach to goal-based investing.

LADDER YOUR FDs TO CREATE A CUSHION AGAINST RATE CHANGES • The fixed deposit laddering technique might make more sense for your investments, as interest rates are hard to predict and do not always go the way we...

Mar 01 2025

Mar 01 2025

Februrary 2025

Februrary 2025

Jan 01 2025

Jan 01 2025